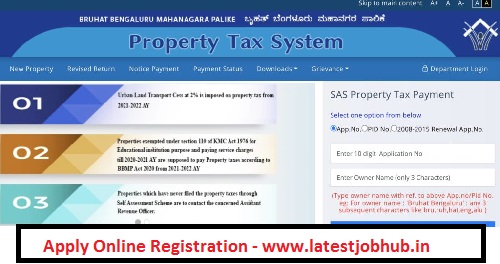

BBMP Property Tax 2021-22 – Bruhat Bengaluru Mahanagara Palike SAS Property Tax Payment Registration Process, BBMP Property Tax Payment, BBMP Property Tax Payment Online Last Date

Every Year the people of Bangalore who own any residential property should pay House Tax to the Bruhat Bengaluru Mahanagara Palike. For the welfare of their citizens, this tax is utilized by the Municipal for giving various civic facilities & services. 30th June 2021 for 2021-22 AY full property the rebate period was extended. Here we will provide you the various important information about BBMP Property Tax. The taxpayers who want to get information about tax can read this article till the end.

BBMP Property Tax Payment Online Registration Process

Bangalore has plenty of people from across India. Most people move to Silicon Valley for work. The Bruhat Bengaluru Mahanagara Palike charges property tax to those who purchase real estate in Bangalore city.

Every Year people who own a property in Bengaluru must pay the property tax to the Bruhat BBMP. The calculation of the property tax is based on the Unit Area Value (UAV). The Online process to pay the property tax is simple.

BBMP Property Tax Overview

| Summary of House Tax or Property Tax | BBMP Content |

| Municipal Corporation’s Name | Bruhat Bengaluru Mahanagara Palike |

| Area | 709 sq. km. |

| Total Population | 84.4 lakhs |

| Contact Email ID | comm@bbmp.gov.in |

| Official Website | https://bbmptax.karnataka.gov.in/ |

How to Pay BBMP Property Tax Online 2021-22?

Here below we had mentioned a simple step-by-step guide to pay BBMP Property Tax Online 2021-22:

- Visit the BBMP property tax portal i.e. https://bbmptax.karnataka.gov.in/

- Enter the Property Identification Number or SAS Application Number and click on ‘fetch’. After that, it will display all the information regarding the property owner.

- Click on ‘proceed’ in case the details displayed on the screen are correct, require no changes. Doing so will redirect you to fill the IV form.

- In case any changes need to be made to the property, like occupancy or built-up area, property usage, click on the box and then hit ‘proceed’. After that, it will take you to fill Form 5.

- Make sure that the information that has been pre-filled is correct. You can then proceed to make the tax payment which can be done either in installments or in full either through a Challan or online.

- In case you select the online payment option, you will be redirected to the payment page where you will have to select the mode of payment, viz. debit/credit card/ net banking. After you have successfully made the payment, the system will generate a receipt number that can be viewed, printed, or downloaded after 24 hours.

Notification for BBMP Tax Payers 2021-22

- Urban Land Transport Cess is imposed from 2021-22 AY, on property tax at a 2 % rate.

- The scheme of self-assessment must contact the Assistant Revenue Officer concerned with the properties in which property tax is not filed.

- Till 2020-21 AY has paid service charges are also supposed to pay tax from 2021-22 AY as per the BBMP Act 2020, the tax for that property which is exempted under the Section 110 of the KMC Act 1976 for the purpose of any educational institution.

BBMP Property Tax Forms

There are 06 from to choose to Pay BBMP Property Tax. They are as follows:

| BBMP Property Tax Forms | Description |

| Form I |

Must be used when the owner of the property has the Property Identification Number (PID), which is a distinctive ID assigned to every property. It contains important details regarding the street, ward as well as the plot on which the property rests. |

| Form II |

Must be used when the property owner does not have the Property Identification Number but has a Khatha number instead. This number is basically the number of a Khatha certificate that is issued for every property. The certificate has all the information regarding the property. |

| Form III |

Must be used when the owner has neither the Property Identification Number nor the Khatha number. |

| Form IV |

It is a white form that must be used in case there are no changes or alterations in the property details. |

| Form V |

It is a blue form and it must be used in case there are changes or alterations made to the property. For instance, if a new floor has been added to the house or the property has been demolished and changed to ‘non-residential from ‘residential’. |

| Form VI | Must be used when the property under assessment is exempt from property tax. |

Property Tax Rate in Bangalore

In Bangalore, the property tax rate differs depending on the category. For residential properties, the present zonal classification under the unit area value method is divided into 06 zones i.e., A to F. The rates are mentioned below:

| Zone | Tenanted (Per Sq Ft) | Self-occupied (Per Sq Ft) |

| A | Rs. 5 | Rs. 2.50 |

| B | Rs. 4 | Rs. 2 |

| C | Rs. 3.60 | Rs. 1.80 |

| D | Rs. 3,20 | Rs. 1.60 |

| E | Rs. 2.40 | Rs. 1.20 |

| F | Rs. 2 | Rs. 1 |

Disclaimer – We have tried to give you important information associated with the BBMP Property Tax 2021-2022. In case of further queries, you can contact us through comments.