Aadhaar-PAN Link: How to Link Aadhaar with Pan Card Online and Offline Step by Steps

Penalty up to Rs 1000 for not linking PAN with Aadhaar Card Before 31st March, Follow how to Link them online and Offline

Link PAN with Aadhaar: Hello guys, the Last Date to link PAN card with Aadhaar is 31 March 2022. If someone skips the deadline, they will have to pay a penalty and bear other consequences. Therefore must link PAN with Aadhaar using the below step-by-step process.

Earlier the government had extended the deadline to 30 September 2021 and now it will end on 31 March 2022. So to avoid any penalty, get your PAN linked with Aadhaar.

Many Candidates are searching How to Link Adhaar with Pan Card Online and Offline. So they must read this article carefully to link PAN card with Aadhaar.

PAN Aadhaar Link Last Date Extended-

One more year for PAN-Aadhaar link- The Central Board of Direct Taxes (CBDT), the apex policy-making body for the Income Tax Department, has extended the last date for PAN-Aadhaar linking by a full year to March 31, 2023. CBDT also issued a notification regarding this late in the evening on Wednesday. It is written in the notification that in order to reduce the inconvenience to the taxpayers, the time period for linking Aadhaar with the PAN card has been extended till March 31, 2023. This is the fourth time that the government has extended the last date for linking PAN with Aadhaar.

PAN Not Linked to Aadhaar? You have one more Year Now, but the Free run is Over

People whose PAN card is not yet linked with Aadhar. After this new arrangement of CBDT, it will continue to work without any hindrance till March 31, 2023. In this way, from filing income tax returns to getting refunds, it can be used as before.

Till now taxpayers were not required to pay any money for this work. But now this free service has stopped. In such a situation, if a taxpayer links his PAN-Half between 1 April 2022 to 30 June 2022, then he will have to pay a fee of Rs 500 and after that a fee of Rs 1,000.

How to Link PAN with Aadhaar? Here is a Step by Step Guide

It is mandatory to link your PAN with your Aadhaar number. Also, it is mandatory to quote your Aadhaar number while filing Income Tax Return (ITR), applying for a new PAN and availing yourself of monetary benefits from the government like pension, scholarship, LPG subsidy etc.

The government announced to extend the deadline for linking PAN with Aadhaar by six months i.e. from September 30, 2021, to March 31, 2022. If you do not link your PAN with your Aadhaar, your PAN will become inactive from April 1. 2022, unless the date is extended by the government. Wherever it is mandatory to mention PAN, such as opening a bank account, etc., you will not be able to use your PAN for doing financial transactions. Here is how you can link your PAN with Aadhaar.

If you are already a registered user on the Income Tax e-filing website-

If you are already filing an income tax return, chances are that your PAN is already linked with Aadhaar if you have given it earlier while filing ITR in previous assessment years. This is done by the Income Tax Department if the details of both are already available.

You can check whether your Aadhaar is already linked with your PAN by visiting the Income Tax e-filing website www.incometaxindiaefiling.gov.in.

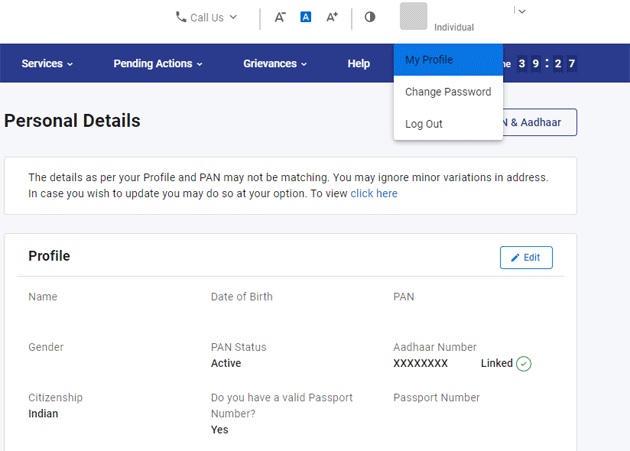

Login to the website by entering PAN (User ID) and Password. Once you are logged in and your account is opened, click on the arrow next to your name and click on ‘Profile Settings’. The profile will show your Aadhaar number as partially linked.

Link PAN with Aadhaar- For non-registered users

If you don’t want to register yourself at the e-filing website, there is another way using which you can link your PAN and Aadhaar. A hyperlink has been provided on the homepage of the new income tax portal: www.incometax.gov.in

Simply click on ‘Link Aadhaar’ on the e-filing website. A new form will appear where you will have to enter the details – PAN, Aadhar Number, Name and Mobile Number as per Aadhaar.

If you have only the year of birth on your Aadhar card, you must also tick this option: ‘I have only year of birth in Aadhar card’. You also have to agree to validate my Aadhaar details. Click on ‘Link Aadhaar’.

After successful submission, a message will be displayed on your screen showing that your PAN is successfully linked with Aadhaar.

Hariom Pipe Industries IPO Date

Other methods

a) By sending an SMS to PAN service providers

If you are unable to link your PAN and Aadhaar using the e-filing website of the department then there are other ways for linking PAN and Aadhaar.

Central Board of Direct Taxes (CBDT) in its notification dated June 29, 2017 has provided other methods to link PAN and Aadhaar other than the methods mentioned above.

You can link your PAN and Aadhaar by sending a simple SMS. You can send an SMS to either of the PAN service providers namely NSDL e-Governance Infrastructure Limited or UTI Infrastructure Technology and Services Limited (UTIITL).

You can simply send SMS in a specific format using a keyword to either 567678 or 56161.

The format is: UIDPAN<12 digit Aadhaar><10 digit PAN>

For example, if your Aadhaar number is 111122223333 and PAN is AAAPA9999Q. Then you are required to send sms to 567678 or 56161 as

UIDPAN 111122223333 AAAPA9999Q

NSDL and UTI won’t charge you for this. However, SMS charges as levied by the mobile operator will be applicable